[ad_1]

The time interval non-public finance ratios may give you flashbacks to math class, finding out quite a few formulation, equations, and ratios. Once more then, if school college students appeared like that they had been zoning out, your teacher may have instructed you “hear, it will in all probability be useful to you later.” Properly, this time, you don’t must attend—a great deal of the equations beneath will in all probability be useful to you correct now!

Let’s research further about what ratios are and fourteen of the very best money ratios you need to use as we converse!

What’s a non-public finance ratio?

In mathematical phrases, a ratio is mainly a way to look at two numbers. Since finance is all about numbers, which will develop into helpful in some methods significantly when making financial calculations!

It is best to make the most of ratios to keep up observe of many various options of your financial situation—from cash stream to monetary financial savings to concepts for retirement planning and further.

A regular ratio is expressed as a divisible amount, nevertheless among the many ones beneath use multiplication or subtractions instead.

Lastly, merely contemplate it as a way to look at your money and the best way you use it. Conserving a report of your money ratios might illuminate how these numbers change over time.

14 of basically probably the most useful non-public finance ratios

The simplest method to make clear the ratios is just to start displaying you examples! So beneath, we’ll make clear tips about learn how to use every and why they’re usually helpful to your journey.

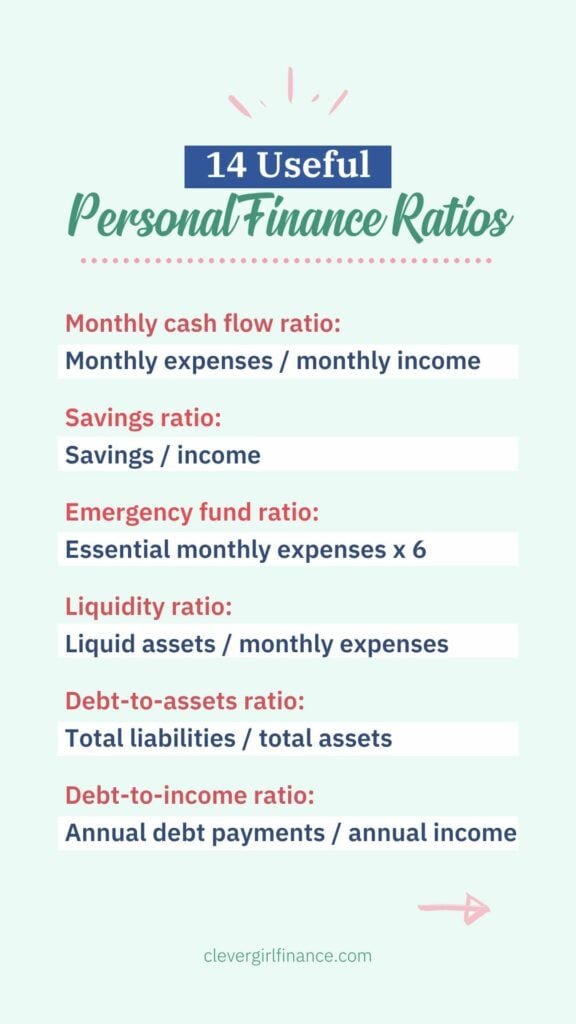

1. Month-to-month cash stream ratio

Month-to-month payments divided by month-to-month income

The month-to-month cash stream elements helps you understand what share of your income is dedicated to your month-to-month payments. Think about the cash stream ratio as how lots cash flows in vs flowing out.

Start by together with up all your widespread income from jobs, side gigs, funding income, and so forth. It is best to make the most of a gross decide or your exact take-home pay (aka internet income) after taxes.

Then, create or search recommendation out of your spending journal or a worth vary template or instrument to see how lots you spend every month. Don’t embrace monetary financial savings or investments in your spending calculations (that has its private non-public finance ratio)! All of the issues else is sincere recreation: necessities, vehicle funds, pleasant money, presents, month-to-month cash owed, and so forth.

Do you have to spend spherical $2,000 month-to-month and make $2,500, your cash stream ratio could be $2,000 / $2,500 = 80%. It tells you that 80% of your income is spent on payments.

2. Monetary financial savings ratio

Month-to-month monetary financial savings divided by month-to-month income

That’s primarily the flip side of the one above. In its place of telling you the best way lots you’re spending month-to-month, it tells you your monetary financial savings worth.

Embody all kinds of monetary financial savings proper right here. Whether or not or not you’re inserting money in a monetary financial savings account, your group’s 401(okay), your non-public IRA, an funding account, and even isolating bodily cash, it qualifies.

Using the an identical month-to-month numbers as above, let’s say you’re inserting the rest of your money ($500) in course of economic financial savings and investments.

Your month-to-month monetary financial savings ratio could be $500 / $2,500 = 20% monetary financial savings worth. You’ll be able to even do the an identical to look out your annual monetary financial savings ratio. Which means, you’ll decide when you want to save further to dwell greater or if the amount you save is wise.

3. Emergency fund ratio

Essential month-to-month payments x 6

An emergency fund exists to protect you throughout the event of unusual payments or job loss. It’s money you want to preserve merely accessible so you need to use it as rapidly as needed.

As a full-time freelancer, I’ve had months the place I’ve a ton of purchasers and initiatives, along with months the place enterprise is barely slower. My emergency fund supplies me peace of ideas that I gained’t be in a dire situation if my work schedule changes.

Given that widespread data is to save lots of a number of 3-6 months of payments in your emergency fund, this ratio shows that. Merely multiply your essential month-to-month payments by 6 to present you your purpose for a completely stocked emergency fund.

After I say “essential,” I suggest you might be slicing out just a few of your “pleasant” budgets for this one. Merely embrace the problems you’ll’t dwell with out (housing, utilities, meals, medical insurance coverage, and so forth).

Our occasion particular person would possibly normally spend $2,000 a month, nevertheless let’s say that they’ll pare down their essential payments to $1,500. $1,500 * 6 = $9000 could be the purpose for his or her emergency fund.

Keep this money in an interest-bearing account—ideally, a high-yield monetary financial savings account. Which means, it ought to keep accessible everytime you need it, nevertheless the curiosity will help you develop your money whereas it’s there!

4. Liquidity ratio

Liquid property divided by month-to-month payments

The liquidity ratio is among the many non-public finance ratios fastidiously tied to your emergency fund since they every revolve throughout the idea of liquidity. Put merely, liquid property search recommendation from (A) cash or (B) completely different financial property you’ll quickly convert into cash.

Money in a checking, monetary financial savings, or money market account is extraordinarily liquid. In case you’ve monetary financial savings bonds you’ll cash in any time, they’re liquid.

In case you’ve shares, bonds, index funds, and completely different “cash equivalents” or completely different extraordinarily liquid investments that you can merely promote within the market, they’d qualify as liquid, too. (Nonetheless, their price fluctuates further, so it’s not a safe amount).

The truth is, you’ll’t merely promote your personal residence on a whim for quick cash, so that’s a great occasion of a non-liquid asset. Money saved in retirement accounts could be illiquid since withdrawals are subject to loads of pointers and take time.

After getting these figures, working the liquidity ratio elements will reveal what variety of months your liquid internet worth would possibly help you. So for any person with $20,000 in liquid property who spends $2,000 a month, it’s $20,000 / $2,000 = 10 months of coated payments.

5. Debt-to-assets ratio

Full liabilities divided by entire property

Now we’re transferring into some doubtlessly a lot much less pleasant territory: just a few debt ratios. Don’t be scared in case your numbers are elevated than you’d like at first. It’s all part of your debt low cost journey!

Do you have to don’t know the place you’re starting from, you’ll merely be stumbling spherical at nighttime, hoping your debt will in all probability be gone sometime.

You may also hear the debt-to-assets ratio known as a solvency ratio. (Normally, “solvency ratio” is a time interval used for firms further normally than individuals.) It’s a way to see whether or not or not you’ll repay your cash owed by selling your property.

Start by together with up your college loans, any consumer debt like financial institution playing cards, non-public loans, vehicle loans, and irrespective of completely different form of debt you carry.

Then, calculate the value of your key property, along with all monetary financial savings and funding accounts, paid-off autos, and personal valuables.

In case you’ve $10,000 in entire liabilities and $40,000 in entire property, you’ve got gotten $10k / $40k = 25% as lots debt as property.

Is a house counted as an asset or obligation?

What about your non-public residence? Is a house an asset or a obligation? It’s every! Besides your mortgage is paid off, you’ve got gotten equity in your personal residence and debt on the same time.

House owners can choose whether or not or not or to not add their remaining mortgage stability as debt and residential equity as an asset on this ratio.

Keep in mind that since mortgages are the largest loans most people might have of their lives, along with it might probably make your ratio seem skewed. Do you have to like, you’ll run the numbers with and with out the home factored in to see the excellence.

6. Debt-to-income ratio

Annual debt funds divided by annual income

That is among the many non-public finance ratios which will help you identify how plenty of your income is being funneled in direction of your cash owed yearly.

To begin out your equation, take a look on the cash owed you gathered above. Nevertheless this time, add up your yearly funds in course of each of them.

One exception is that for many who’re a home proprietor, it’s most interesting to exclude mortgage debt from this equation—that’s a surefire approach to kill your ratio! (Plus, housing funds fall further into common payments than debt payoff.)

Subsequent, you’ll divide your annual cash owed by your annual income. Normally, people use their gross income pretty than internet income for this calculation. Embody any income from side gigs and numerous sources as successfully.

As your cash owed shrink, the outcomes of this ratio will, too! Nevertheless for many who’re together with new cash owed or paying points off too slowly, compound curiosity may enhance your debt funds and, subsequently, this ratio.

Any person making $15,000 in annual debt funds whereas incomes $50,000 a 12 months is paying $15k / $50k = 30% of their income to their debtors.

For firms, an an identical ratio known as the “debt servicing ratio” helps lenders assess a enterprise’s debt compensation talent.

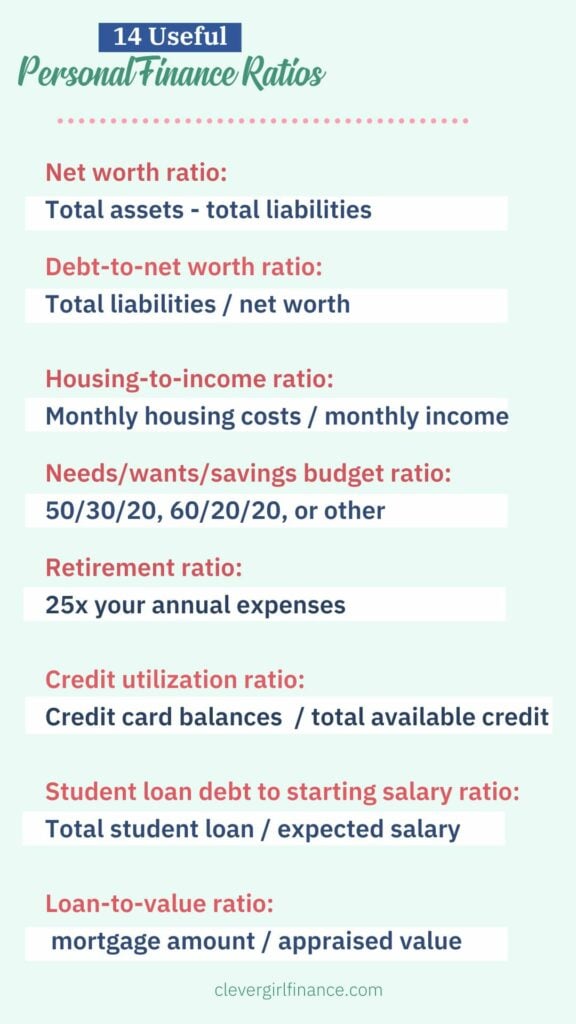

7. Web worth ratio

Full property minus entire liabilities

The net worth ratio goes to be fast and sweet! Seize the an identical numbers you utilized in #5, nevertheless instead of dividing, we’ll merely subtract.

Property minus liabilities help you calculate your internet worth! It’s motivating and fulfilling to look at this amount develop over time.

$40,000 property – $10,000 liabilities = $30,000 internet worth.

8. Debt to internet worth ratio

Full liabilities divided by internet worth

That’s much like the debt-to-assets ratio.

Nonetheless, you aren’t merely evaluating entire debt to entire asset price with this one. In its place, you’re evaluating your debt to the net worth decide from #7—the place debt has already been subtracted out of your asset price.

The ratio is meant that may assist you resolve how lots debt you’ve taken on relative to your internet worth.

In case your ratio is over 100%, you would possibly actually really feel over-leveraged and battle with funds. The lower the tip end result, the additional comfortable you’ll actually really feel alongside along with your debt ranges.

$10,000 liabilities / $30,000 internet worth = 33% debt to internet worth ratio.

9. Housing-to-income ratio

Month-to-month housing costs divided by month-to-month income

You’ve most likely heard some suggestion for spending a positive share of your income on housing. Beforehand, the rule of thumb amount was 30%. Now, there’s a barely further detailed model known as the 28/36 rule.

The first half (28) means you could objective to spend no more than 28% of your income in your entire residence price, along with taxes and insurance coverage protection.

The second half (36) supplies your mortgage price to all your completely different debt funds and recommends that this entire not exceed 36% of your income. It’s efficiently the an identical issue as your debt-to-income ratio from #6 (nevertheless a mortgage-inclusive mannequin).

The 28/36 rule is a implies that will assist you weigh whether or not or not your non-public residence purchase would put you in an extreme quantity of debt.

For instance, if a doable dwelling purchase would bump you too far over the 36% debt-to-income decide, you may want to take a look at cheaper properties. In another case, you run the possibility of turning into residence poor!

Do you have to’re spending $1,000 a month on housing whereas making $3,500, you’re spending $1k / $3.5k = almost 28% on housing.

10. Needs/wishes/monetary financial savings worth vary ratio

50/30/20, 60/20/20, or completely different

Want a non-public finance ratio that gives you a quick info on dividing your payments? There are a variety of strategies to do this.

Usually, one of the best methods comprise breaking down your payments into desires, wishes, and monetary financial savings. Needs are each factor you’ll’t dwell with out, wishes are the nice-to-haves, and monetary financial savings are what you place aside to your future.

The 50/30/20 rule

One widespread worth vary ratio often called the 50-30-20 rule. On this elements, 50% of your income goes to necessities, 30% is reserved for discretionary income, and 20% will get saved.

Let’s see how this may work for any person who makes $3,000 a month. The 50/30/20 ratio would suggest $1,500 goes to desires, $900 to wishes, and $600 to monetary financial savings/investments.

Totally different percentages

All of these numbers might be tweaked relying in your situation.

So for many who’re spending 60% of your income on necessities, you may want to objective for further of a 60 20 20 breakdown or even the 70-20-10 worth vary.

11. Retirement ratio

25x your annual payments

Ever find yourself asking, “Can I retire however?” If you stop working, you want to be assured that your monetary financial savings and investments can have the power to proceed funding your life.

It’s a tried-and-true methodology for understanding what you need in retirement. It’s moreover based totally on one factor known as the 4% rule, which refers back to the idea {that a} retiree can safely withdraw 4% of their monetary financial savings yearly with little risk of understanding.

Calculating your retirement payments

Take a look at your current annual payments and check out to find out within the occasion that they’ll be elevated or lower in retirement. Perhaps you’ll have a paid-off residence by then and eradicate lease/mortgage payments.

On the flip side, you may want to try full time touring or have additional for medical care. It in no way hurts to pad the numbers, nevertheless the 25x payments elements is an efficient place to start.

Any person who spends $50,000 a 12 months would ideally want $50,000 * 25 = $1.25 million to retire confidently.

12. Credit score rating utilization ratio

Sum of financial institution card balances divided by entire obtainable credit score rating

Your financial institution card utilization ratio helps current how efficiently you deal with your obtainable credit score rating. Extreme utilization would possibly signify that you’ve an unhealthy reliance on debt.

Utilization could be an unlimited contemplate determining your FICO credit score rating ranking, so it’s worth paying attention to for many who’re making an attempt to boost your credit score rating. Understanding and managing this ratio can positively impression your creditworthiness and financial well-being.

Figuring out your credit score rating utilization

To calculate it, take the current sum of your revolving credit score rating account balances and divide it by the entire credit score rating limits all through all your accounts.

A lower credit score rating utilization worth helps your credit score rating ranking. Avoid going over a 30% credit score rating utilization ratio—holding it at or beneath the ten% range is true. Give consideration to paying off wonderful cash owed and limiting the balances you carry from one month to the next.

Take into consideration a state of affairs the place your financial institution card balances amount to $2,000, and your entire credit score rating limits all through all taking part in playing cards are $10,000. The credit score rating utilization ratio could be $2k / $10k = 20%. Which means that you simply’re using 20% of your obtainable credit score rating.

The benefit of utilization is that it primarily changes every month. Even when you’ve a extreme ratio for one month, you’ll pay down your balances and return to a low utilization in a short time.

13. Pupil mortgage debt to starting wage ratio

Full amount of pupil mortgage, divided by anticipated starting wage

College is notoriously expensive. And besides you know how to get a full journey scholarship or have a faculty fund, it could be laborious to stare these pupil mortgage provides and charges of curiosity throughout the face and ask your self, is it worth it?

The debt-to-salary ratio provides a simple info for college school college students and their households to help reply this question. Will your diploma be properly well worth the debt in the long term?

This elements helps you identify the utmost mortgage amount to borrow for a particular diploma program.

How do I inform if my college diploma will in all probability be worth it?

Since you’ll’t predict the long term, it’s unattainable to calculate the exact ROI (return on funding) for a faculty diploma. Nevertheless you’ll take a look on the job market in your purpose topic and resolve what starting income you’ll rely on after graduation. Websites like wage.com would possibly assist with this evaluation.

Your outcomes may even help you propose a smart debt compensation schedule to your college loans. As a rule of thumb, school college students ought to limit their debt-to-starting-salary ratio to decrease than 100% to repay the loans over roughly a 10-year interval. (The truth is, charges of curiosity can affect the exact timeline.)

So, let’s say you’re taking out $30,000 in loans, and your anticipated starting income is $50,000. The debt to starting wage ratio could be $30,000 / $50,000 = 60%. The tip end result signifies that your debt could be 60% of your anticipated starting wage, which is relatively conservative and low-cost.

Then once more, borrowing $60,000 for a degree that ends in a median starting wage of $30,000 would not make as lots financial sense. That may put the ratio finish end result at 200%—double the advisable amount.

It would not matter what your diploma costs, enroll in our free pupil loans 101 course bundle to be sure you clearly understand how they work.

14. Mortgage-to-value ratio

Remaining mortgage amount on a property, divided by its appraised price

The loan-to-value (LTV) money ratio is a vital metric throughout the realm of precise property financing. Lenders reference this ratio as a part of the mortgage approval course of. Moreover they ponder it for refinancing and residential equity line of credit score rating (HELOC) features. A low LTV is good because you owe a lot much less on the mortgage.

Whether or not or not you’re a gift home-owner or a potential first time dwelling purchaser, this non-public finance ratio will in all probability be associated to you.

How the LTV ratio works for model new dwelling customers

Do you have to’re looking for a home, your preliminary LTV will depend on the dimensions of your personal residence down price. Let’s say you place 20% down on a house valued at $200,000, so your down price is $40,000 and your mortgage is $160,000.

That makes your LTV ratio equation $160,000 / $200,000 = 80%.

Do you have to solely put 10% down, you’ll be left with an LTV of 90%. Larger LTVs on new dwelling purchases can embody further costs, like elevated mortgage charges of curiosity and private mortgage insurance coverage protection (PMI).

The larger your down price is, the smaller your LTV will in all probability be, and vice versa. Saving up not lower than a 20% down price will get you basically probably the most favorable phrases.

How the LTV ratio works for homeowners

For current homeowners, the LTV represents how lots equity has constructed up in your own home, i.e. how plenty of the mortgaged property you private. This decide moreover determines whether or not or not you’ll refinance at a lower fee of curiosity or entry a home equity line of credit score rating.

Your LTV will decrease as you pay your mortgage, nevertheless it might probably moreover change in case your appraised property price changes.

In some circumstances, LTV can enhance if a property’s market price drops. It is going to in all probability happen if there’s property damage (e.g. from flooding) or a recession hits. Nevertheless it’s relatively extra widespread to your LTV to decrease as your precise property price grows, which is a helpful change.

Let’s say you bought our occasion dwelling when it was valued at $200,000. After 5 years, you proceed to owe $125,000, nevertheless your property price has appreciated to $250,000. That new price is the decide you’ll use for the ratio: $125,000 / $250,000 = 50% instead of $125,000 / $200,000 = 62%. It’s like getting additional equity with out spending a dime!

Skilled tip: Take into consideration money ratios all through the context of your life

Okay, you’ve merely gone by way of a great deal of math—take a breath! Now might be the time to remember these math equations are most insightful everytime you put them into context. A single ratio isn’t going to provide a whole view of your financial properly being.

It is best to in no way actually really feel harmful if just a few of your ratio outcomes are above or beneath one of the best numbers. You don’t must dwell and die by money ratios! They’re solely a info, and there’s always room for exceptions and adaptableness based totally in your distinctive situation.

Maybe your required college diploma doesn’t embody an incredible starting wage…nonetheless it’s a topic you’d love working in, with good future progress options. Don’t rule it out because of a math equation.

Take into consideration all of them all through the context of your non-public core values, desires, and targets to make them be simply best for you.

Why are non-public finance ratios obligatory for you?

These ratios are good strategies to distill tried-and-true financial data into simple formulation that anyone can use.

For those who want to know whether or not or not your monetary financial savings are on observe—there’s a ratio for that. Curious for many who’re spending an extreme quantity of on housing? There’s a ratio for that.

Realizing your financial numbers would possibly assist you improve your life

Furthermore, holding a report of these numbers lets you replicate on the place you bought right here from. As you research new frugal life hacks, you’ll pare down your payments and improve your cash stream ratio.

As your income grows and in addition you repay debt, these debt ratios shrink in entrance of your eyes whereas your internet worth swells.

They’re some satisfying little equations that give you one different approach to look at your funds and set new targets.

What are essential ratios for money?

Finance is a extraordinarily individualized journey, so the importance of explicit ratios can differ based totally on explicit individual circumstances and financial targets. Nevertheless sometimes, there are only a few ratios that everyone have to be paying attention to.

The emergency fund ratio is one amongst my excessive strategies for the beginning of your financial journey. Life can throw curveballs at anyone, anytime.

Having not lower than six months of payments squirreled away helps give you a runway to find out points out for many who get laid off, should pay for a shock dwelling or vehicle restore, and so forth.

I’ll moreover highlight the monetary financial savings ratio, which includes standard monetary financial savings and investments. Monetary financial savings are primarily your key to the long term. They put all your targets in attain, whether or not or not it’s looking for a house, paying off your loans, or early retirement.

What’s an efficient debt to internet worth ratio?

An amazing debt to internet worth ratio strikes a healthful stability between leveraging debt for wealth-building and avoiding excessive indebtedness.

You may assume it’s most interesting to try for no debt.

Nonetheless, whereas which can be a worthy objective for some people, it isn’t always the case. In some situations, debt is normally a instrument that may assist you greater your financial properly being.

It ties into the concept of types of debt, like good debt vs. harmful debt.

As an illustration, pupil mortgage debt or enterprise debt would possibly assist you make more money all by means of your lifetime. Nevertheless financial institution card debt will eat your income with its high-interest expenses.

You can give it some thought relating to these ranges:

- Most safe range: A ratio beneath 50% is generally considered healthful—indicating that your internet worth isn’t lower than twice your entire debt.

- Common range: Ratios between 50-100% can nonetheless be manageable, counting on the situation. Think about the kinds of debt you’ve got gotten, its perform, and whether or not or not it contributes to your basic financial well-being.

- Cautionary ranges: Ratios exceeding 100% level out that your entire debt surpasses your internet worth. It alerts the subsequent diploma of financial risk, so proceed fastidiously and assure you’ve got gotten a powerful debt compensation approach.

Articles related to organized funds and financial literacy

Do you have to’ve added these ratios to your financial toolkit, you’ll love these reads!

Calculate your non-public finance ratios!

Now it’s formally your flip!

With a view to start crunching the numbers, you’ll need some key objects of data in entrance of you. The precept stuff you’ll need embrace:

- Full annual income

- Full month-to-month income

- Full cash owed/liabilities

- Month-to-month payments (broken down by class)

- Full asset price

- Liquid asset price (aka cash or points you’ll quickly flip into cash)

- Credit score rating limits in your taking part in playing cards

- Precise property price (for property householders)

After getting these figures in entrance of you, the remaining is just plug-and-play. You can recalculate these non-public finance ratios as normally as you want—say, as quickly as a month, as quickly as 1 / 4, or yearly—to carry on excessive of your non-public financial plan. Over time, for many who preserve the course, you may even uncover methods to vary into wealthy!

[ad_2]

Provide hyperlink