[ad_1]

Assume you don’t have the funds for to start out out investing? Assume as soon as extra! You can uncover methods to start investing for newbies as we converse, even for many who start your investing journey with merely $100.

Although you could start out by investing small portions, it could be a turning degree in your funds. Investing money for newbies doesn’t should be exhausting each!

When you decide to start out out investing, essential part of the tactic is educating your self. Finding out simple strategies to make investments for newbies will present assist to ease your self into it and steer clear of frequent errors. After you’ve gotten a larger understanding of investing, you will actually really feel further comfortable as an investor rising your investments over time.

In case you’re learning this, then you definitely’re within the applicable place to get started. On this put up, you’ll discover out about simple strategies to start investing for newbies. And this data applies whether or not or not you possibly can have solely a little money to take a position or some large money to take a position!

(P.S. As a lady, analysis current you can be an incredible investor!)

What’s investing?

When you decide to take a position your money, you are choosing to put it proper right into a car with the intention of receiving a return down the street.

In the end, you hope that the money you place into an funding will develop. Most frequently, you plan for little ongoing involvement in your half while you’ve invested the money.

Although most people affiliate investing with the stock market, there are numerous numerous sorts of investments. As an illustration, you could spend cash on precise property or your private enterprise. Lastly, you’ll decide your private funding mannequin as you go.

It would not matter what property you choose to spend cash on, you hope to earn money on that funding ultimately.

Why is investing important?

Investing is among the many best strategies that you possibly can develop your money for the long term. Nonetheless, investing is not the an identical as merely saving money. Let’s take a look at a few reason why investing is so important.

Investing can beat inflation

Saving money is an important place to start out out developing a larger financial future. Nonetheless, your monetary financial savings are diminished each day by the powers of inflation. Although your monetary financial savings account may want the an identical stability ten years from now, that money just isn’t going to have the an identical shopping for vitality that it has as we converse.

Investing might appear to be an expense, nonetheless truly, with worthwhile investments, attempt to be getting all that money once more plus further. With investing, you can develop your money over time and maintain the powers of inflation at bay.

Historically, the stock market has provided returns between 6% and 7%, with inflation factored in. These returns can develop your monetary financial savings dramatically over time.

Compound curiosity grows your money

The ability of compounding can add to your nest egg. Ought to you choose to reinvest your earnings over the course of some years, you’ll revenue from the compounding impression. Compounding is a course of that grows your money over time by reinvesting your funding earnings.

Your money is always working for you

In case you’re merely starting your journey of developing wealth, then investing will enable you attain your long-term targets faster. In its place of shopping for and promoting your time for money with the intention to assemble wealth, you could have your money provide the outcomes you need.

When your money begins to earn money by way of your investments, you gained’t be totally dependent in your day job or your monetary financial savings.

When do it’s important to start investing?

Sooner than we dive into how to start out out investing, let’s focus on when it is best to start investing. Investing strategies generally comprise a long-term timeline. With that acknowledged, the best time to start out out investing is as rapidly as attainable.

The sooner you can start investing, the additional time you’ll have to allow your investments to develop. Even when you’re investing for newbies with small portions, it will add up over time.

Sometimes, you will use these investments to fund your retirement. So it is a good suggestion to start out out as rapidly as you could. You’ll want to offer your investments a great deal of time to assemble your wealth.

Finding out simple strategies to start investing is an particularly important part of your financial journey. Nonetheless, there are some issues that it is best to type out sooner than you start investing. Let’s take a extra in-depth look.

After you pay down high-interest debt

Paying off debt is the 1st step as you start fascinated by investing for newbies. When you’ve gotten any debt that is draining your property each month, then it is best to take care of paying that down first.

Notably, objective to knock out any high-interest debt, as this debt costs you in all probability essentially the most due to compounding curiosity. An occasion could be high-interest financial institution card debt.

While you’ve paid down your debt, you’ll be succesful to make investments further comfortably.

When you possibly can have an emergency fund

Residing one paycheck from the sting is not an excellent feeling. An emergency fund may also help you get pleasure from further financial respiration room in your life. Sooner than you start investing, take into consideration developing an emergency fund.

While you’ve paid down your debt and constructed an emergency fund, then it is time to revisit the topic of simple strategies to make investments for newbies. Must you start youthful, then the power of compounding can work in your favor. Even for many who solely have a few {{dollars}} to start out out investing, it is best to take movement as rapidly as you could comfortably obtain this.

Keep in mind, in case your employer affords a free match in your investments, you positively must reap the advantages of this match ASAP. It is mainly free money!

The correct technique to start investing money for newbies

Investing can change your financial future for the upper. You don’t need some large money to start out out investing. In some circumstances, you solely need a few {{dollars}} to get started.

In spite of everything, you could have a intention of accelerating your investments over the long term. Nonetheless don’t let restricted property stop you from developing your long-term wealth.

1. Examine regarding the numerous sorts of investments

There are plenty of numerous sorts of investments, and it’s important that new patrons understand all of them. Then you could choose the alternatives that are best for you when you create your funding portfolio and financial plan.

Proper right here’s an inventory of quite a few the sorts of investments you’ll encounter as you make financial alternatives:

Explicit particular person shares

Explicit particular person shares are shares of a corporation you can purchase and have partial possession.

Bonds

A bond is a type of mortgage that you possibly can spend cash on and obtain curiosity and your a reimbursement over time.

Mutual funds

With mutual funds, your money is pooled with completely different patrons and used to purchase many different sorts of investments like shares and bonds.

Index funds

A few of the customary types of mutual funds are index funds. They monitor a specific stock market index, similar to the S&P 500. If you are going to buy a share of an index fund, you primarily get barely piece of every stock inside that index.

ETFs

Typically often known as exchange-traded funds, these are similar to mutual funds, nonetheless are traded on the open stock market.

Purpose-date funds

A target-date fund is one different subclass of mutual funds. They’re designed for patrons who’ve a specific date in ideas after they’ll need to make use of their funding money.

REITs

Typically often known as Precise Property Funding Trusts, these enable you spend cash on income-producing precise property (you are investing inside the agency that owns the precise property).

2. Create your plan for investing

Subsequent, it’s time to take a seat down down and create your main plan for investing. Do you possibly can have debt to repay first? Is your emergency fund the place you’d want it to be? In that case, you’re ready to start out investing for newbies.

As you develop into accustomed to the varied sorts of investments, you’ll want to evaluation their professionals and cons. For instance, investing specifically particular person shares shall be quite a bit riskier than a diversified S&P 500 index fund. Decide what types of investments you might want to take care of.

Do you already have some money saved up that you just’d like to take a position? Decide for those who want to put it accessible available in the market right away as a lump sum, or steadily by buck worth averaging.

Lay out your non-public targets for investing as successfully. For most people, one large intention is funding their retirement. Nonetheless you may need completely different targets for investing too. Presumably you might want to buy a house in ten years. Or ship your kids to varsity. Investing will enable you develop your money for these targets too.

We even have a free course that may help you create a plan in your future self by way of investing!

3. Resolve how quite a bit money it is best to make investments

On this step, you’ll be crunching some numbers! First, you’ll want to find out how quite a bit money you’ll need in your intention. Then, you’ll calculate how quite a bit you’ll need to speculate over time to realize that target.

Some consultants advise saving 10% of your earnings for retirement. Nonetheless is that mainly ample? It’s decided by how quite a bit you make, as soon as you might want to retire, and the best way quite a bit you want in your accounts by then. Proper right here’s the best way to decide if 10% is ample.

In case your purpose numbers are a lot larger than the amount you could realistically afford to take a position, you’ll should look into strategies to increase your earnings.

It is potential you will work for a company, the place you likely have entry to some employer-sponsored funding accounts. Usually, these accounts are geared towards serving to you save in your retirement in a tax-advantaged methodology. Many employers provide a 401(okay) or 403(b).

In case your employer doesn’t provide a retirement account, then take into consideration opening an IRA to start saving in your retirement. Within the case of investing money for newbies, these are quite a few the most effective and most accessible decisions—and quite a few the strongest, too!

5. Try a robo-advisor (a great way to start out out investing for newbies)

Robo-advisors are one among many best strategies to start out investing money for newbies. A robo-advisor is mainly a digital financial advisor. Utilizing algorithms and utilized sciences eliminates the need for a human financial advisor.

It will current automated financial administration suppliers and tailor your funding solutions based in your targets. Using one can positively give you somewhat little bit of a shortcut as you uncover methods to start investing money for newbies.

The benefit of using a robo-advisor is that the costs are generally low, regardless that you simply’re getting custom-made portfolio solutions. It is a great way to get started with developing wealth with little money.

Most robo-advisory firms provide low account minimal requirements and take care of portfolio rebalancing for you mechanically.

In case you’re interested in making an attempt a robo-advisor and want to find methods to make investments for newbies with one, then attempt our favorite funding apps beneath:

- E*Commerce: An award worthwhile app that makes investing easy.

- M1 Finance: A extraordinarily rated app that allows you to automate your investing.

- Wealthfront: Means which you could mechanically diversify your portfolio for long-term investing.

- Ellevest: This app focuses significantly on female patrons’ targets and takes your values into consideration for investing.

- TD Ameritrade: Means which you could commerce your investments merely.

- Acorns: Means which you could start investing with merely $5, and it has the attribute of a round-up monetary financial savings account.

- Betterment: A secure selection with computerized investing in index funds.

- SoFi: Begin with merely $1 and no administration expenses.

6. Seek out a brokerage account

Must you’re opening an IRA or one different non-public funding account, you’ll should do it by way of a brokerage. There are plenty of on-line brokers accessible accessible in the marketplace as we converse. Each affords completely completely different suppliers and prices completely completely different expenses.

As you sift by way of your decisions, take into consideration what points to you most. In some circumstances, you may must buy and promote shares ceaselessly. Transaction expenses for this will add up shortly at some brokerage firms.

In several circumstances, you could choose to spend cash on index funds with expenses inbuilt. Each methodology, you’ll want to find a brokerage account that minimizes expenses in your funding mannequin.

Many brokerage accounts are organize so you could uncover methods to start investing with little money. Listed under are a couple of good on-line brokers to start out out with:

- Interactive Brokers: Award-winning supplier with out the extreme worth.

- E*Commerce: Affords a quick and simple course of to open an account.

- Webull: There should not any deposit minimums with this well-reviewed supplier.

- Charles Schwab: An especially customary supplier which will present assist to collectively along with your investing needs.

- Fidelity: Recognized for its a very long time of investing experience.

- TD Ameritrade: Affords low expenses and a great deal of funding strategies.

7. Bear in mind certificates of deposit (CDs)

Certificates of deposit (CDs) are a safe place to develop your money while you’ve bought a low risk tolerance.

Although you will likely miss out on bigger returns by way of the stock market, you gained’t have to stress about any dips alongside the best way through which.

CDs could possibly be a notably good selection to save lots of numerous up for short-term targets. Must you anticipate needing money in a pair years, you could not must risk investing it inside the stock market, which has intervals of ups and downs.

8. Spend cash in your self (an enormous part of simple strategies to start investing)

Investing in your self is just as important as investing inside the stock market. You might choose to spend cash on your financial education, which can forestall 1000’s of {{dollars}} over the course of your life.

You might choose to spend cash in your small enterprise, which can enable you take administration of your earnings.

Or you could choose to spend cash in your nicely being. After all, a healthful physique makes life further pleasurable. Listed under are some solutions for residing a healthful life-style on a funds!

9. Proceed with investing over time

Within the case of investing money for newbies and seasoned consultants alike, consistency is important! The additional frequently you make investments, 12 months after 12 months, the nearer you’ll get to your targets.

The following tips will present assist to maintain fixed in life, it would not matter what habits you’re engaged on. Whether or not or not it’s investing for newbies, consuming extra wholesome, or staying organized, fixed movement will make all the distinction.

Educated tip: Take your time and don’t make impulsive alternatives

When you first uncover methods to start investing for newbies, you’ll be learning by means of a complete lot of information. And it could even seem pretty easy! Merely do X, Y, and Z, and likewise you’re all set—correct?

Nonetheless it’s always completely completely different when you’re merely learning about one factor vs. when you’re actually doing it your self. There are an entire lot of feelings which will embrace the territory of investing and money administration.

Presumably your coworker suggested you about this “scorching new stock” and acquired you truly keen about it. Sooner than you make investments your hard-earned money, take a pause. Do your private evaluation to find out if it’s truly a sound switch, or a harmful gamble.

Equally, there might very nicely be a day when the market has a stoop and loads of people are panic selling. Will you let your self get caught up in that, or will you retain calm, cool, and picked up because you had been already mentally prepared?

Since emotions are non everlasting, attempt to not base funding alternatives in your feelings or what the oldsters spherical you are saying. Make your plan based on evaluation and knowledge, and keep it up! This vogue, you don’t should be afraid of the stock market.

Investing money for newbies: The place do it’s important to make investments first?

Now you already learn about quite a few the completely completely different investing decisions and simple strategies to start investing for newbies. That acknowledged, for many who’re searching for out the place to get started with investing first, listed under are our options.

1. Leverage tax-advantaged retirement monetary financial savings accounts out of your employer first

An employer-sponsored retirement plan is the easiest place to start out out investing money for newbies. Examples of these account varieties embody 401k, 403b, and 457b. By leveraging tax-advantaged accounts, you could take full good thing about their tax benefits.

Usually, your contributions to your retirement account could be taken out of your paycheck sooner than your taxes are deducted (usually often known as your pretax earnings). This reduces your taxable earnings. Consequently, the taxes in your earnings after these deductions (post-tax earnings) could be lower on the end of the 12 months.

Moreover, these accounts provide a deferred tax revenue. This suggests you don’t must pay taxes in your investments until you start to make withdrawals on the accounts while you attain retirement age (age 59.5). Or on the required withdrawal age set by the IRS (age 72).

2. Prepare your private IRA

Subsequent, you could go about establishing a traditional IRA or Roth IRA (Explicit particular person Retirement Account).

In case your employer would not provide any type of retirement monetary financial savings plan, an IRA is an effective place to start out out. These account varieties even have their very personal tax advantages, which makes them notably beginner-friendly. There is a contribution limit for these, based mostly on the IRS, that attempt to take heed to, though.

Standard IRAs have the an identical tax benefits as typical 401(okay)s. Roth accounts are barely completely completely different, because you pay taxes in your contributions the an identical 12 months instead of prepared until it’s time to withdraw. Examine further about Roth IRAs and completely different 401(okay) alternate choices proper right here.

3. Open your private brokerage account

While you’ve completely leveraged the tax-advantaged accounts you are eligible for, it is also potential to open a each day brokerage account. It will enable you make investments any further money you possibly can have after you possibly can have maxed out your tax-advantaged accounts.

Keep in mind that whereas a each day brokerage account is a taxable account, you don’t must pay any taxes until you actually promote your investments. All these taxes are often known as capital constructive elements taxes.

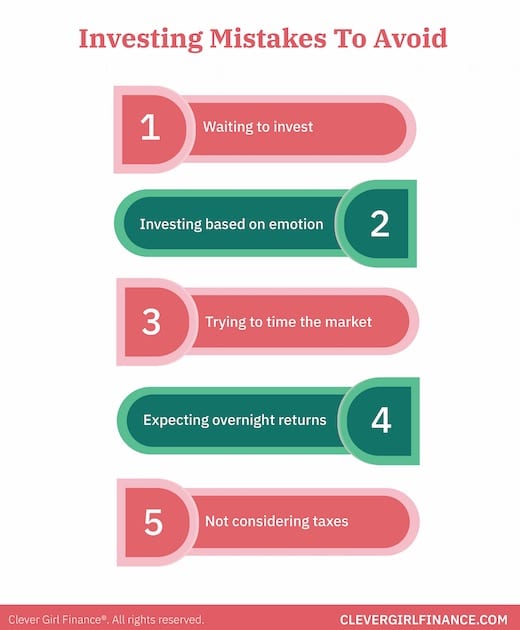

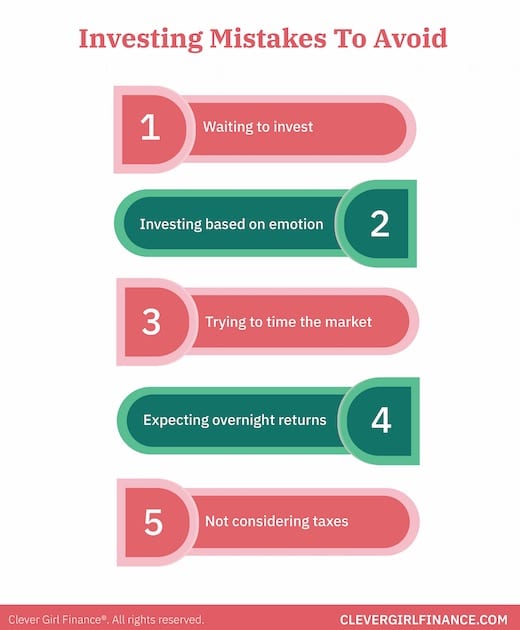

What to remember as you uncover methods to start investing for newbies

Investing is an effective technique to assemble a secure financial future. Nonetheless, there are some pitfalls to look out for as you uncover methods to start investing. Ought to you may steer clear of a couple of of those errors, you then stand to save lots of numerous your self 1000’s of {{dollars}}.

Understand the costs (and steer clear of them)

When you uncover methods to start investing and begin making an attempt by way of funds to spend cash on, you’ll uncover that each comes with a set of expenses.

In numerous circumstances, the costs can differ from 0.5% to 2%. Although that tiny swing in share elements might not appear to be an important factor, it could probably make an enormous distinction in your portfolio’s progress.

Truly, a 2% cost might add as a lot as an entire lot of 1000’s of {{dollars}} over the course of your investing career. When you decide to take a position, it is best to you’ll want to evaluation the costs and cut back them wherever attainable.

Put collectively collectively along with your risk tolerance in ideas

If you choose to take a position your money, it is best to imagine that you just might lose a couple of of your funding alongside the best way through which. The market will rise and fall and there are various fluctuations.

Although it historically has risen by way of the years, that is not an indicator that it will proceed to rise steadily. It is likely that there could be some dips alongside the best way through which.

It is rather essential understand your risk tolerance and take into consideration that as you make investments your money. Take our quiz to realize a larger understanding of your risk tolerance. Researching your investments could be key by way of assessing risk.

You additionally must think about your investments by the use of what’s a long-term intention or a short-term intention. Make it part of your non-public finance plan to grasp how quite a bit you’re investing for the near future and the best way quite a bit for retirement, as this will affect how quite a bit risk you are taking with investments.

Diversify with numerous sorts of investments

The simplest technique to mitigate your risk accessible available in the market is diversification of your investments. You don’t must pool your entire investments into one specific agency that goes under.

In its place, you want your investments unfold out in numerous sectors of the market. If one house of the market falls, then you definitely’ll not be left with a badly sinking portfolio. As you uncover methods to start investing for newbies, try to get a combination of property like shares, bonds, mutual funds, and additional.

Two good diversified portfolio varieties to ponder are the three-fund portfolio and the all-weather portfolio.

Rebalance alongside the best way through which

When learning simple strategies to make investments for newbies, it is best to plan to stay on excessive of your investments over time. Simply be certain you’re nonetheless on monitor collectively along with your targets and that the timeline nonetheless matches into your targets.

The market will rise and fall, you’ll should rebalance to just be sure you don’t depart your entire eggs in a single basket.

Automated rebalancing could be an unbelievable methodology to creating certain your portfolio is always in alignment.

Don’t try to time the market

Keep in mind, investing is a long-term method to assemble wealth. You should not try to time the market by looking for low and selling extreme.

Not even in all probability essentially the most superior patrons can continuously beat the market. In its place of looking out for short-term wins, take care of long-term targets and constructive elements.

Although you gained’t assemble wealth in a single day by way of the stock market, you could with a couple of years of fixed investing.

Don’t neglect about taxes

Keep in mind taxes if you end up planning out your investments. There are completely completely different strategies that it’s best to use to lower your potential tax burden, nonetheless they require cautious planning.

Must you aren’t constructive regarding the tax implications of your state of affairs, then take into consideration chatting with a tax expert.

Don’t wait to take a position

Although it is vitally essential educate your self sooner than investing, you should not wait too prolonged to get started. With investing, you might want to have the price of time in your aspect.

The sooner you can start investing, the upper, as your investments can have further time to develop. That time might end in important progress due to the vitality of compounding.

Stay away from making emotional funding alternatives

When you uncover methods to start investing, you will perceive that you have some sturdy emotions linked to your investments.

After all, you are hoping that these investments will end in a larger future. And lots of people have a concern of loss that may make investing harder.

The stock market comes with highs and lows, and attempt to be emotionally able to local weather these storms. When the market inevitably drops, you should not pull your entire money out of the market.

In its place, it is best to attend until it rebounds and also you’re capable of make a withdrawal. Nonetheless, that’s easier acknowledged than completed.

In an effort to steer clear of a painful experience, you’ll want to know your risk tolerance sooner than you start investing. With that, you could choose investments that are a lot much less extra more likely to set off panic in your life. Persist with what makes you comfortable, and always make your funding alternatives with a clear head.

Keep in mind, nothing happens in a single day

You should not assume that your money will develop in a single day as soon as you start investing. Truly, it will rise and fall many cases on the best way through which to progress.

As you get started, perceive that investing is a long-term method for wealth developing. Nonetheless it isn’t going to make you rich in a single day.

What sort of funding mannequin is finest for you?

The one one who can determine the easiest funding mannequin for you is you.

It is important to think about how outdated you are, how prolonged until you retire, and what your risk tolerance is. Previous that, think about your character and what’s sensible for you.

Robo-advisor decisions are best for people preferring to have barely administration over their very personal investments and like experience. Others preferring some non-public steering might must work with a financial advisor to debate their decisions. After researching, choose what you’re comfortable with.

How should a beginner start investing?

Listed under are the essential factor steps summarized by way of how a beginner ought to start investing:

- In case your employer affords a retirement plan like a 401(okay), focus on to HR about establishing contributions.

- Whether or not or not or not you possibly can have a chunk retirement plan, it is also potential to open an IRA by way of numerous on-line brokers and spend cash on that.

- To make further investments exterior of retirement accounts, open a each day funding account with a brokerage company or robo-advisor service.

These three decisions will enable you make investments as quite a bit money as you want!

Is $100 ample to start out out investing for newbies?

$100 is totally ample money to start out out investing for newbies! Many on-line brokers have low account minimal requirements to make investing accessible to further of us. Some don’t have an account minimal the least bit, so you could even start investing with $10 if you want!

Furthermore, some brokerages provide fractional shares, usually often known as “stock slices” as a technique to make investments.For instance, for those who want to buy a share of a stock or index fund that costs $200, nonetheless you solely have $100, this will permit you to buy half a share.

Is $1,000 an excellent start for investing?

Reaching your first $1,000 invested inside the stock market is an occasion worth celebrating! That’s a thousand {{dollars}} which will immediately get to work and start rising.

When you want to earn further money so you could make investments $1,000 every month, think about starting a aspect gig. Listed under are 30+ strategies to earn an extra $1,000 a month.

Articles related to investing for newbies

Must you liked this textual content on simple strategies to starting investing, do that related content material materials:

The following tips make simple strategies to start investing for newbies a breeze!

The simplest technique to assemble wealth by way of investing is to get started as rapidly as attainable. You can uncover methods to start investing as we converse! Even for those who’re merely starting with $20, you could assemble your portfolio over time.

When you want to research further and make good funding alternatives, then take into consideration taking our totally free investing course.

You’ll research further about simple strategies to start investing money for newbies, simple strategies to evaluation your investments, and simple strategies to determine the suitable supplier for you.

And don’t forget that investing is one part of your whole financial nicely being. There are plenty of completely different belongings you additionally must discover out about like saving, budgeting, and managing your money. All of it matches collectively like a puzzle—and the picture it reveals is an beautiful financial future!

[ad_2]

Provide hyperlink